Aercap

Be Greedy When Others are Fearful

At the time of writing this, Aercap is trading at $18 a share with $71 in equity per share, giving us a 0.25xBV multiple. The market is implying that $7bn out of the $9bn in total equity will be wiped out - let's investigate that claim.

Overview of the Business

Aercap is the largest lessor of aircraft in the world, with a 12% market share. The business model is to debt finance aircraft ownership, lease out those aircraft, and make money off the difference between the cost of debt and rental rate - this spread is called the net interest margin. Earnings are equal to net interest margin less depreciation less cash operating expenses.

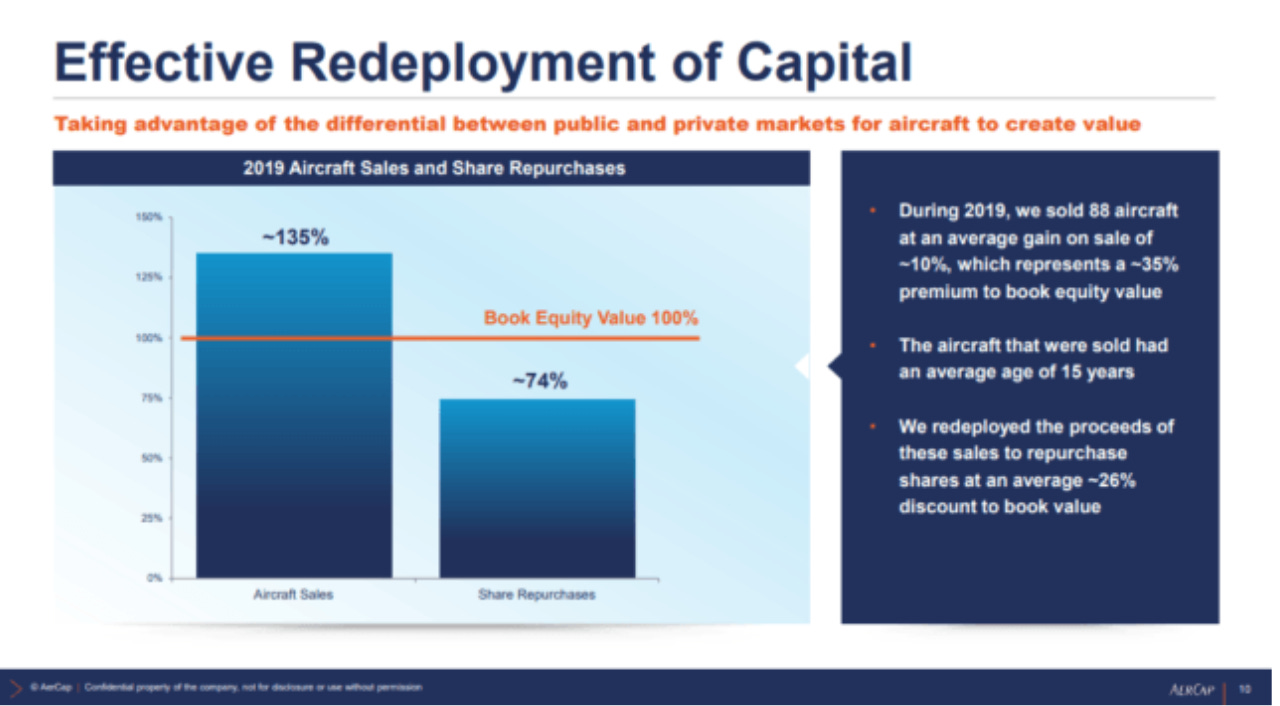

The other way Aercap makes money is by trading aircraft. An aircraft's useful lifespan is approx 20-25 years, and this is usually split into two lease periods. Once the first lease period runs out Aercap can either lease the aircraft out again for the rest of its life or sell it. Trading aircraft profitably requires a large sales network, market data, employees, and a prudent depreciation policy. Management refers to these things as Aercap's 'platform', which has enabled them to consistently sell aircraft at 130% of BV. Aercap's size and phenomenal management give them, in this regard, a competitive advantage.

This business model has three main risk factors;

1) Funding risk. Aercap needs to be able to finance aircraft ownership through debt at attractive rates and maintain sufficient liquidity.

2) Credit risk. Lessees may default resulting in asset impairment.

3) Residual value risk. Aircraft must be properly depreciated, or else Aercap will take a loss later on when they sell the aircraft. This risk does not immediately effect net income, but rather becomes apparent over time. There is no evidence that Aercap is deviating from its historically prudent depreciation policy.

What's changed over the past 6 weeks that would cause Aercap's stock price to fall 70% from $62 to $18? Which risks are the market pricing in?

Needless to say, the coronavirus has lead to a substantial grounding of the global aircraft fleet putting a financial strain on Aercap's customers. However, as a lessor and a secured creditor, Aercap's financial well-being is not as directly tied airlines to the short term performance of airlines as one might assume. The questions to ask now are how many of their customers will go bankrupt, of those who go bankrupt how many default on their leases, how much of Aercap's assets will be impaired as a result of lease defaults, how much of this will flow through to the equity, and wether Aercap will stay solvent through the crisis.

Aercap's management is well aware of the risks within the airline industry and is prepared for situations like this. This is why Aercap hasn't lost money a single year of operations, despite a financial crisis, $140 oil, terrorist attacks, and natural disasters. There were 23 airline bankruptcies in 2019, yet Aercap made record profits. Aercap is a senior secured creditor in that they have the first claim on payment in the case of bankruptcy, and collateral should the lease be rejected. Lease contracts have a "hell or high water" provision, meaning that come hell or high water the lease payments must be made. Their agreement with the airline LATAM reads;

"LATAM irrevocably and unconditionally guarantees to AerCap on demand the due and punctual performance of the Guaranteed Liabilities. LATAM also agrees to indemnify AerCap and the relevant Lessor on demand in relation to any Losses suffered or incurred by AerCap"

That's not to say Aercap won't suffer lost revenue because of this crisis; in fact, they will and it's in their interest. Aercap is currently under negotiation will Norwegian Air shuttle, a highly distressed airline which is likely to dilute equity 99% in the coming months, to defer lease payments and probably convert debt to equity. Although most of Aercap's customers are in a better situation than Norwegian, there will be many others entering similar negotiations. It's in Aercap's interest to defer lease payments such that the airlines do not go bankrupt, that way they have a future customer. As I will describe shortly, Aercap has sufficient liquidity to do this.

Why I think the market is over-estimating credit risk.

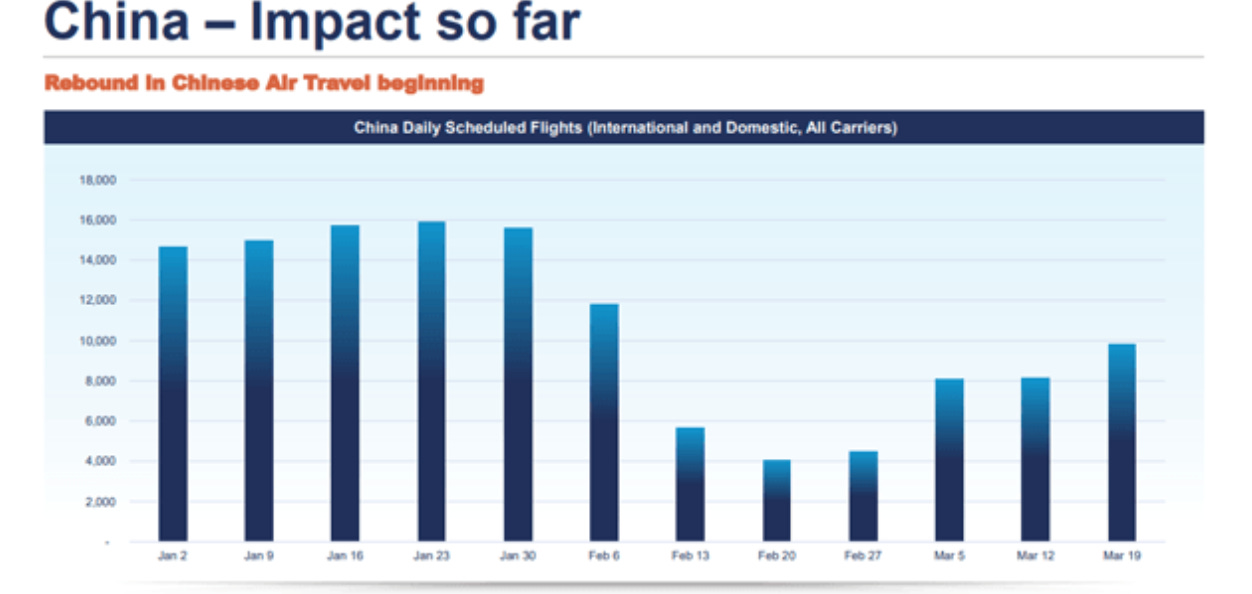

Aercap has $36bn worth of aircraft, so for $7bn in equity to be wiped, there must be 20% impairment in the aircraft's' value. I believe this to be very improbable for the following reasons. ~40% of Aercap's customers are either Chinese or a state-backed airline. China is already in the midst of an air-traffic rebound and has not seen any defaults so far. State-backed airlines will in all likelihood be bailed out in any event. These parts of the book are safe.

Let's make some extreme assumptions and say that of the remaining 60% of customers, 50% of them go bankrupt (30% of aircraft assets). Of these, 50% default on half of their leases (15% of aircraft assets). Loss given default is historically 50%, so now we are left with 7.5% aircraft asset impairment. 8% of $36bn is $2.9bn, meaning we left with $6.4bn in equity.

Given the 'hell or high water nature' of the lease agreements, this outcome is improbable. But even if this worst-case scenario were to materialise, the equity value per share is still $49.

Can this crisis bankrupt Aercap?

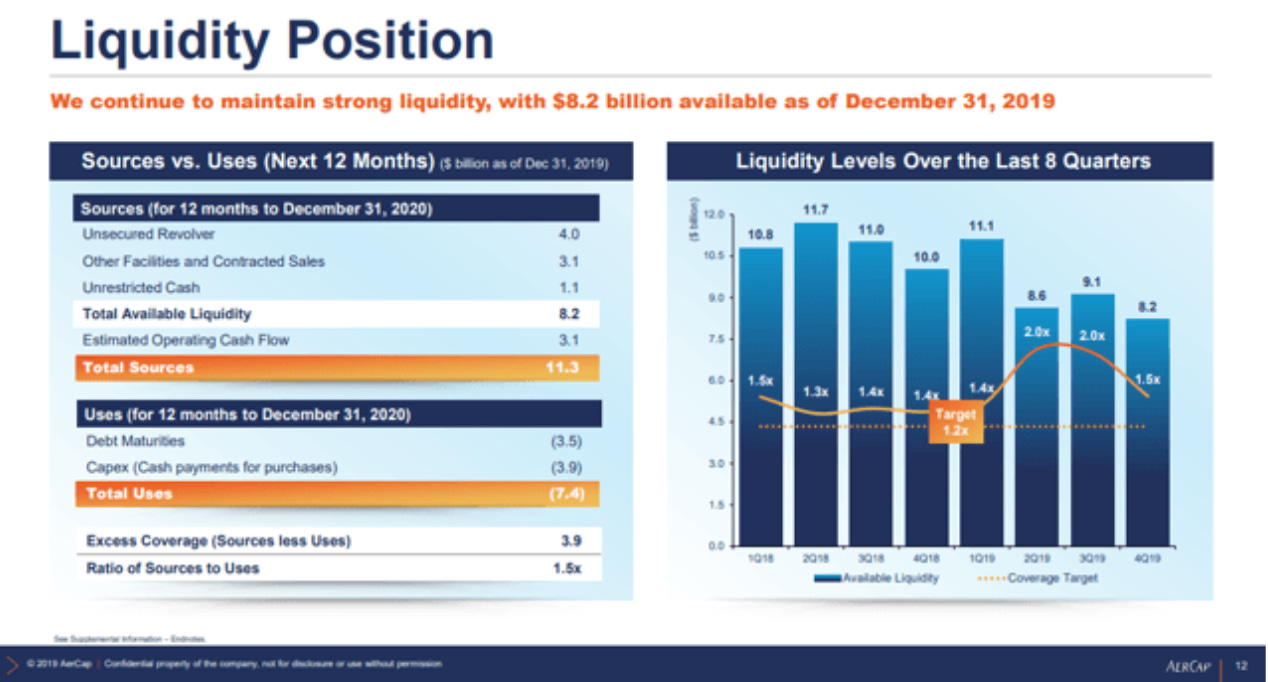

Just to illustrate how unlikely it is that Aercap goes bankrupt, I will make the most extreme assumptions regarding their liquidity. Expected lease revenue for 2020, before the crisis, was $4.5bn - let's assume all that revenue disappears (customers break lease agreements), except for January/February revenue which has already been received, now we are left with 750mil in revenue. Let's also assume that despite a marked decrease in operations, cash operating cost remains the same at $1.5bn. This gives us an operating cash flow of -$750mil. In addition, Aercap has $3.5bn in maturing debt plus $3.9bn in expected Capex from contracted purchase for new aircraft. Assuming none of the debt can be rolled over this all ads up to $8.15bn in liquidity uses. Still, Aercap has $8.2bn in available liquidity - should this somehow not be enough they have $29bn in unencumbered assets that can be collateralised to raise new debt. That Aercap should not have sufficient liquidity to weather this storm is, to me, inconceivable.

None of this means the stock can't go lower In fact given the way markets price things Aercap very well may see new lows as it did during the financial crisis where it fell 90% to $3. For those who bought then and held until 2013 it would have been a 10 bagger, or a 20 bagger if you waited until 2019.

Now let's take a deeper look at a business, make some more reasonable assumptions about where the Aercap is headed, and do a valuation from there.

The long term trend in air travel doubling every 15 years tells a clear story; people will continue to travel the world. With the exception of a cataclysmic event, there is no reason to believe this trend will stop. The past crisis are mere blips in this chart. 12 months from now its likely air traffic will be back to normal. Absent a depression, we can assume a 5% annual growth in air traffic for the foreseeable future.

Additionally, there is a trend away from owning aircraft and towards leasing as this is a more capital efficient model for airlines. Lessors will stand to benefit from this. The number of aircraft in the world has doubled in the past 20 years but the number of leased aircraft has quadrupled.

How much will Aercap realistically make in net income?

In 2019 lease revenues were 4.6bn. Keeping in mind that 40% of Aercap's customers are already more or less safe, I think it's reasonable to assume that 50% of customers will need to defer lease payments (including some of those in China) and 10% will run into serious solvency issues. Of the 50% who need to defer payments, they will still make some payments, whether it's a fraction of the original lease or it comes later in 2020, let's say that on average half of the revenue from these airlines gets deferred until 2021 (even though January and February have already passed with full revenue), so that's a 25% ($1.15bn) revenue reduction. Let's also say Aercap is unable to sell any aircraft at a net gain this year, that's another $200 mil. less revenue. Of the 10% who run into solvency issues to the extent that they default on all their leases, this revenue is gone never to be seen again. Additionally, these aircraft will need to be impaired by 50%(given historical LGD rates); so 50% of 10% of $36bn is $1.3bn. Adding this $1.3bn to Aercaps $3.6bn in normalised expenses, then subtracting this from revenue - we are left with a $1.11bn pre-tax loss. This should come to an approx -$1bn in net income for 2020. To be conservative, let's just ignore any bounce back in 2021 from 2020 deferred revenues and assume no future growth. Normalised earnings over the past three years are $1.23bn. Plugging -$1bn for year one into a discounted cash flow and then $1.23bn for perpetuity, it takes a 21% discount rate to get to today's market cap of $3.4bn. Either way, you look at it, this seems like a pretty good deal to me.

Other scenario's with worse outcomes:

With many worrying about lasting macroeconomic troubles, given 30+ years of financial engineering, another scenario could be a depression where air travel is down 20% for 5 years. For instance, Ray Dalio stated explicitly in a recent Ted interview that this will be a depression similar to that of the 1930s. I'm not one to say that Ray Dalio is right or wrong, but I think we should look at how Aercap would do in this scenario - then investors can decide for themselves how much they want to weight this scenario in their model and how this risk fits into their portfolio. Aercap has $40bn in contracted lease revenues, with 97% of these lasting through 2022 and the average lease end date being Q3 2027. Although the market value of aircraft may decline, it's rare to impair an aircraft if it still has a lease contract. Additionally, 58% of their fleet NBV is new technology aircraft. This is important because, should there be a prolonged decrease in air traffic, lease rates for new technology will fall less than that of old technology. If lease rates fall Airlines will need to retire aircraft earlier than otherwise, so if they are going to retire aircraft anyways then they may as well keep the more efficient (new) ones - this creates a rotation from old to new technology. This is the same effect as in shipping where old tankers get scrapped when freight rates fall.

It's hard to know exactly how a scenario like this would play out, there are many factors and the branching stream of probabilities endless. Deflationary or inflationary environment? Will central banks be able to keep rates low? What happens to lease rates if air traffic is down 20% for 5 years? I don't know the answers to these questions, but what I do know is that Aercap is the best in the business and has phenomenal management - so if anyone could get through it it's them. Strong liquidity and a record of good capital allocation are reassuring. Aercap has compounded equity 15% at over the past 5 years, while simultaneously reducing debt/equity. They've also sold aircraft on average at 135% of book value while buying back shares at 74% of book value on average.

Aercap largely hedges away interest rate risk away so this is not a large concern to me. As of 2019 68% of debt was fixed-rate, they had interest rate cap's and swaps covering 19% of debt, and 13% of debt in cash, floating rate leases and other - for a total of 90%. Based on these numbers a 1% increase in interest rates would only cause a $25mil. increase in interest expense. In the short run rates will go lower because of central banks which will decrease interest expense but also lower new lease rates. In the longer run I don't know where rates will go, but a larger spread on the yield curve would benefit Aercap over time.

A larger concern is lease rates if economic activities slow and air traffic stagnates. Given the short term inelastic nature of aircraft supply, say a 20% decrease in air traffic causes a 50% decrease in lease rates (even after old aircraft retire). Given that half of leases run through to Q3 2027 this would cause a 3.5% decrease in lease rates per year as old contracts roll over. Additionally, aircraft may be impaired and debt levels may need to decrease in such a Marco- environment.

Conclusion

I am not overly concerned about the macro risk as there are other ways to hedge this in one's portfolio. Given the long term trend in air traffic growth, a P/E ratio of 3, potential for growth, and a large yet unsubstantiated discount to book value, I see this as one of the best risk/rewards out there.

Catalyst - Once coronavirus blows over, and the recession ends, people will return to the skies. Aercap will emerge from the crisis mostly undamaged with much less asset impairment and more equity than the market is discounting. This will lead to a re-rating. Absent a depression, this will easily trade back at $60 within 3 years and $100 within 5.

Disclosure: I am long Aercap.