Protector Forsikring (PROT.OL) Research,Analysis & Valuation

EXECUTIVE SUMMARY

Protector is a young and fast-growing property-casualty insurer with an industry-high underwriting margin. Protectors’ fast growth came along with underwriting errors which lead to a negative underwriting margin in 2019. I believe this was a temporary issue that has since been remedied and that protector has structurally lower costs than the competition. At a CAPE of 11, this company is significantly undervalued.

OVERVIEW

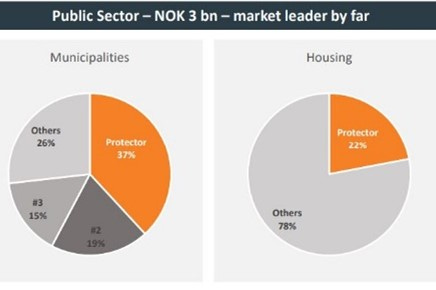

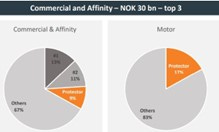

Protector forsikring is a Norwegian insurer, focusing on property-casualty. It’s the third-largest P&C insurer in the Nordic’s and the largest in the public sector. The Nordic market is one of the most consolidated in the world with strong underwriting discipline. Was founded in 2004 and has grown to 6bn NOK in gross written premiums (GWP) annually. This growth has been powered by quality leadership, internally developed IT, and industry-low costs. The company’s premiums come 33% from fire and other property damage, 23% other motor insurance, 12% motor vehicle liability, 11% workers compensation, 7% general liability insurance, 6% life insurance, and 8% other (medical expense, income protection, marine, aviation, and more). All business is conducted through intermediaries. Protector only does business with the government and business, and this is sold through insurance brokers.

Investment Case

Protector has a trailing 12 month P/E of 8.3 and will likely continue to grow profitably at ca. 8% in the next years. This growth will be funded organically and will be highly accretive to shareholders due to Protectors’ ROE of 36%.

After delivering a strong bottom line in 2020 and ’21 Protector has a meaningful capital surplus not yet distributed. Protector is trading at much lower prices than it’s Nordic peers by any metric, and I believe the market will continue to re-rate this company as their growth and

profitability trajectory becomes increasingly obvious.

P&C is counter-cyclical which is a good portfolio addition in the current macroeconomic environment.

MAIN RISKS

Policy mispricing, slowed growth, and market volatility.

INDUSTRY STRUCTURE

I would just like to spend some ink to remind ourselves what to look for when analysing an insurance company. This is a checklist to go through as we are assessing the investment case. Even the most seasoned airline pilots are required to use checklists!

Insurance is a twofold business. On one side you make money off premiums less claims less operating cost. This is referred to as the technical result. The other side makes money from the time value of the money times a risk premium of the float generated by the fact that premiums are paid before claims. The size of this float is the time-weighted average size of premiums – The average time between a premium and a claim multiplied by the volume of premiums. This is referred to as the investment result.

On the technical side, the most important number is the combined ratio (or underwriting margin). Combined ratio is the sum of claim ratio and cost ratio, as a percentage of net insurance premiums earned. Underwriting margin is just (1 – combined ratio), they represent the same metric. Claim ratio can be reduced by having higher prices and/or having better risk models. Cost ratio is composed of primarily sales costs, claim processing costs, IT costs, and administrative costs. Historically, Protector has done well on both fronts. Why this is and how sustainable it is we will get into.

On the investment side is there a large degree of idiosyncratic (non-systematic) risk associated with the type of portfolio each insurance company decides to run. Many portfolios carry significant interest rate and macroeconomic risk – because they are usually composed of bonds. A principle of any good portfolio management is to hedge out risks. This means insurers should (and do) try to match the maturity of their bonds with the payment paths of their policies. Investors are (and should be) wary of investing in insurers who carry large amounts of long-duration bonds on their books given the current inflation and interest rate risk in the economy. Should interest rates rise, these companies can take serious losses. It’s hard to identify a single KPI on the investment side – the closest is sharpe ratio but this does not take into account qualitative risk factors. You need to look at investment performance over time.

STRATEGY

Vision: The Challenger

Protector (founded in 2004) is still a new player in the market and at the core of their culture they view themselves as an ambitious young company that will disrupt established players and aggressively take market share.

They believe they can do this through unique relationships, best in class decision making and cost-effective solutions.

Strategy: Culture eats strategy for breakfast

At Protector they believe that Strategy is downstream of culture. “Culture eats strategy for breakfast”. I think this is true, the types of strategies that a company develops are a result of the kind of people working there, their common vision, and philosophy around how to effectively run a company.

It is clear they take culture seriously; in their various investor reports, you can find pictures and quotes from Warren Buffett. Buffett followers have even been described as a cult, albeit a good cult – in my opinion. I think this fervent belief in the time-tested principles espoused by Buffett lies as the core of Protectors underwriting and investing success. Berkshire Hathaway is after all also an insurance company.

In line with this philosophy (former) CEO Sverre Bjerkeli says that Protector will continue to focus on the businesses they are best at. This is a wise strategy since it is tempting for a growth-oriented company to enter segments they have no experience in.

Growth strategy:

- Property and casualty insurance

- Competitive prices

- Low cost-ratio

- Broker distribution only

- USP (unique selling proposition): Easy business, commercially attractive, and trustworthy

- Markets: Medium to large companies and public sector.

Sales strategy

In high-frequency low claim value and low complexity insurance I am generally against selling through brokers, because it is simply unnecessary since the product is easy for customers to understand – plus the insurance (fire, property damage, and auto insurance) is so ubiquitous that customers in fact do their own research and go looking for the product. In the case of motor vehicle liability, it is even government mandated to be insured. Therefore, selling through independent agents (or even captive agents) has little extra value and is an unnecessary cost. However, protector sells only to business and government, so this changes the equation slightly. I would still learn towards direct sales, but the advantages are not as large. In net I am agnostic to Protectors’ distribution strategy as I do not think there are very large advantages or drawbacks with either strategy. Sales cost 331mil. 6.1% of GWP, I was unable to find comparable numbers for competitors – but it can be expected that growth comes with additional sales cost.

Former CEO Sverre Bjerkeli defends selling through brokers by saying that selling to business is not like selling to consumers. You have far more complex insurance contracts, many risks, hundreds or thousands ensured entities, difficulties in wording, specials needs and wants on both ends. The broker has a specialised team who know the industry both on the buyer and seller side and they can match Protector with the right client and help negotiate a favourable contract. Yes, it’s possible to build this competence internally but that would be more costly than just using existing brokers. So, the cost is small relative to the benefit.

Investment Strategy:

We see the same philosophy reflected in their investment strategy. In equities they focus on returns from long term ownership, predictable businesses, high margin of safety, low share liquidity, concentrated portfolio, deep analysis, contrarian opinion, overlooked companies, poor sentiment companies or sectors, continuous learning. In bonds they are willing to invest in riskier assets when they believe the RoE will be greater than 20%, but they think taking a higher risk requires a greater margin of safety. They do bottom-up analysis and quarterly follow-ups (good b/c bond market is often slow to react to deteriorating fundamentals) where the thesis is in a continuous process of development. They focus on the absolute attractiveness of the investment with a margin of safety and are selective of ideas (only 5% of ideas are ultimately bought). In turn, this means they also have to sit on the sidelines when there are no good ideas but bet big when they find something. Any investment opportunity will ultimately be evaluated in terms of return on risk capital and opportunity cost.

CULTURE

Sverre Bjerkeli swears by the book “Good to great” and has built the culture in Protector using this framework. The company spent 18 months undertaking a training exercise for management where they internalized the principles laid out in the framework and worked to implement them in the company. The book is now mandatory reading for management.

An overview of the framework:

INPUT STAGES

Leadership -> First who, then what

1. Part 1: Put great leaders with the following traits in powerful seats

a. Ambition on behalf of the organization

b. An iron will

c. An ever-improving track record in decision making

d. Credit others for success

e. Take personal responsibility for failure

f. Lead and inspire primarily through respect rather than charisma

2. Part 2: Create a great leadership culture

a. Culture values substance over style, integrity over personality, and results over intentions.

b. Culture of dialogue and debate. For the sake of better decisions, not for looking good for having won the debate.

c. The team stands together behind a decision once it’s made. Even if they disagree.

d. Employ highly capable individuals, strong contributing team members, competent managers, and effective leaders.

3. Part 3: Get the right people on the bus

a. Rigorous selection process

b. Invest substantial time in evaluating each candidate. Interviews, references, background investigation, meeting family, testing.

c. When in doubt, do not bring the person on board. Be comfortable leaving the seat unfilled because turnover is bad.

d. Do an exceptional job of retaining the right people.

4. Part 4: Get the right people in the right seats

a. Change people quickly once you are sure they aren’t right.

b. Be rigorous in executing a decision, but not ruthless in implementation. Allow people to maintain their dignity -> this creates trust in the organization both internal and external.

c. Autopsy hiring mistakes

5. Part 4: Put who before what

a. Don’t think about what to do, think about WHO should do it.

b. A significant amount of time should be spent making sure the right people are in the right seats.

c. Have a disciplined systematic process for improving success at getting the right people on the bus.

d. With each passing year, the percentage of good decisions on who are the right people for the right roles increases.

Disciplined thought -> Confront reality. The hedgehog concept.

6. Part 1: Create a climate where the truth is heard

a. When things go wrong, conduct autopsies without blame. Seek to understand causes.

b. Leaders should ask a lot of questions rather than make statements. Thereby encouraging a culture of dialogue.

c. Leaders should not allow personally get in the way of bringing forth brutal facts.

d. A culture where people are never punished for bringing forth brutal facts.

7. Part 2: Get the data

a. Make use of data to introspect on weaknesses, strengths, and effectiveness of strategies.

b. Make use of trendline to discover brutal facts

c. Marshal evidence to support claims

d. Pay attention to gut instincts but always conduct a disciplined fact-based assessment before making a decision.

8. Part 3: Embrace the Stockdale Paradox.

a. Never hold false hopes during difficult times

b. Do not be unrealistically optimistic

c. Despite the circumstances have an unwavering faith that we can prevail in the end.

d. Greatness is a consequence of decisions and discipline – not fate.

9. Part 4: Keep it simple, be a hedgehog, not a fox.

a. Specialization is key

b. Have a simply coherent strategy.

c. Pick the simplest option when at a fork in the road.

10. Part 5: Get your three circles right

a. Focus on what we are passionate about, are best at, and drive our economic engine.

b. Nothing can be accomplished without passion.

c. Believe that we can be the best in the world.

d. Understand what drives the business model.

11. Part 6: Act with understanding, not bravado:

a. Great results come from actions taken based on understanding.

b. We are more likely to die from drowning in opportunity than dehydration.

c. We are comfortable with brutal facts.

Disciplined action -> Culture of discipline. The flywheel.

12. Part 1: Focus on your hedgehog

a. Say no to big opportunities that are outside your circle of competence

b. Never grow for growth's sake

c. Willing to jettison core competencies if we can’t be the best in the world

d. Make use of “stop doing” lists

13. Part 2: Build a system of freedom and responsibility within a framework

a. Give employees freedom and responsibility within bounds

b. People should understand their job

c. Be able to say who is responsible for what

d. Culture is a blend of freedom yet responsibility, discipline yet entrepreneurship, rigour yet creativity.

14. Part 3: Manage the system, not the people

a. Hire self-motivated people and create a system that does not de-motivate them

b. Hire disciplined people and create a system facilitating discipline

c. Avoid imposing bureaucracy on good employees.

15. Part 4: Practice extreme commitment

a. A culture of going to extremes to deliver results; sometimes bordering on fanaticism.

b. Disciplines, rigorous, dogged, determined, diligent, precise, accountable, etc.

c. Equality is disciplined in good and bad times. Never complacent.

16. Part 5: Build cumulative momentum

a. Greatness takes time

b. Step by step actions, day by day, week by week, year by year.

c. Spin the flywheel, build momentum

17. Part 6: Be relentlessly consistent over time

a. Consistency

b. Success derives from many interlocking pieces reinforcing each other over time

c. Have an immense ability to adapt to change, but always within your circle of competence

18. Part 7: Create alignment by results, not hoopla

a. Blow people away with great results

b. Never pump up your reputation

c. Do not sell false visions

d. Understand that there will be resistance to change

19. Part 8: Avoid the doom loop.

a. Do not succumb to choosing the lazy easy solution which sounds like a miracle.

b. Do not change so quickly that your flywheel loses momentum.

c. If a new technology fits your circle of competence, integrate it

20. Building greatness to last -> Clock building, not time telling. Preserve the core. Stimulate progress.

…. There is more, but it is taking me too much time to summarize this and the rest is congruent with the aforementioned so I shall spend no more ink on the matter.

I am I big fan of lists, and I think this one is on point. If this culture is engrained in Protector, it gives me much confidence in their continued success.

It’s also worthwhile to note that all the “Good to Great” checklist items seem derivable from Warren Buffett’s mantra.

1. Stay in your circle of competence and know its boundary.

2. Integrity

3. Discipline/Energy/Ambition

4. Intelligence

I basically think these four traits lead to everything else.

OUTPUT RESULTS

1. Superior performance relative to mission

2. Makes a distinctive impact on the communities it touches

3. Achieves lasting endurance beyond any leader idea or setback

DURABLE COMPETITIVE ADVANTAGE

Protector has a cost ratio of 8%, compared to its competitors with an average of 17%. 68 83 85

Insurance is a commodity; the supplier has minimal pricing power. Therefore, the only competitive advantages an insurance company can have are better risk models and lower costs. Better risk models allow you to more accurately access what claims will be on a policy and better predict which contracts will be profitable to enter. In the markets Protector operates in it is very easy to predict on an aggregate level what claims will be - because claims are frequent relative to their value. Additionally, contracts for auto insurance and property damage are typical of duration 1 year or less, allowing protector to frequently reprice policies – which removes much of interest and inflation rate risk. These factors make it functionally impossible to have a competitive edge in risk models and thereby policy pricing.

Most insurers outsource their portfolio management, but in the case of Protector, they manage their own book. In addition, they follow the wisdom of Warren Buffett:

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

Protector is willing to move quickly and to take large bets when they believe the odds are heavily in their favour. In March 2020, there was a crash in the Norwegian high yield bond market over the course of a few days due to the urgent need for liquidity which fuels itself when the stock market crashes and investors get margin calls. During this short period, Protector was buying over 50% of the trading volume. Ultimately resulting in a 5% return on bonds for the year. This is a sign of competence, preparation, and nerves of steel in their investment team. Opportunities like these can appear overnight and when they do you need to act quickly, there’s no time to suck your thumb. Their portfolio is currently composed of 90% bonds and 10% equity. I believe this strategy is what has led to their 5% average investment returns compared to their peers at 3.8%.

This speaks to the competence of the investment team, led by Dag Marius Nereng who has achieved a 19.2% CAGR on Protector’s equity book since 2014. I have listened to an interview with Dag Marius which strengthened my belief in his competence – I would feel comfortable letting him manage my money.

One could argue that there is some more volatility and risk associated with Protector’s investment strategy and that this is the cost of their superior performance. I think this is true to some extent, but I also don’t believe that all alpha is simply a result of taking more risk – I think competent investment teams can find better risk/reward opportunities purely as a result of more insightful analysis.

Having such an investment team is a durable competitive advantage.

RISKS

A mid to long term risk to auto-insurance is AI in cars. Important to note here that “driverless” cars lie on a spectrum of just how “driverless” they are – it’s not binary. Usually, this is classified into 5 levels of autonomy. AI is going to get increasing good at handling all sorts of complex prediction tasks which have historically been restricted to the human domain of competence – that I am sure of. But the time frame is uncertain and there is no consensus or good way to predict this (that I know of). Whether we have full self-driving in 3 or 20 years I don’t know (not to mention regulatory lag) – but what is for sure is that cars will get gradually safer and safer both due to autonomy and electrification (which is occurring at a particularly high rate in Nordic countries). Electric cars are fundamentally safer than ICE vehicles because of the way their chassis is built, their high mass, and low centre of mass. Additionally, modern vehicles have increasingly better telematic instruments on board and we have better automated statistics (also called machine learning) for analysing the data collected – making them yet safer.

The need for insurance is simply a consequence of two things, the risk of significant casualty and our inability to predict to whom those casualties will occur. Insurance is a way for individuals to pool risks that are low but would be unbearable if they should occur. The aforementioned factors all pull in the direction of a decreasing need for insurance generally but particularly auto insurance.

However, this is an industry-wide gradual threat not something specific to Protector. What matters here is that Protector is undervalued relative to its peers. If you believe insurance as an industry will decline, you can go long Protector and hedge by shorting the sector (if the thesis is correct this will guarantee alpha and high sharpe). I personally do not think this is a big enough risk to warrant hedging out. Furthermore, some of this will be counteracted by the simple fact that the number of vehicles on the road has increased in almost every country every year since they were invented – this will continue! Additionally, the insurance market is so large and the product is fungible so even if the sector experiences a secular decline in market size it should not matter to Protector – they can still grow because they have lower costs and can price policies lower. When a market shrinks, it is the unprofitable high-cost actors who leave first. I am not worried about this risk.

I believe the greatest risk to Protector (or any insurer for that matter) is underwriting error. All insurers go through cycles of profitability as they attempt to take market share while retaining a low claim ratio. Periodically they are too ambitious and will experience a year or two of losses because of it. This is what happened to Protector in 2019. But I think it’s to be expected for a company that has a 24% CAGR in revenue to make some underwriting errors. Luckily, since the contracts are short duration, they can be rapidly remedied. Yes, they will probably continue to go through such cycles.

We have seen that the management is strategic with where they expand and experiment with what works and doesn’t. They know when something isn’t working and are willing to pull back. This can be seen recently withdrawing out of workers’ compensation insurance in Norway and Denmark. Workers’ compensation was 11% of premiums in 2020, but -2.6% of net premiums – they don’t provide a regional breakdown of this data. They cited changed regulations in Norway and high capex/low profitability in Denmark as their reasons for leaving - we can expect a 200mil NOK reduction in premiums from this. I think much of decision-making is just about avoiding obvious errors rather than making ingenious moves – and in the case of management in Protector, it seems this is what they are good at.

That said, Protector has a premium to Equity ratio of 1.5. This is low enough that an underwriting error wouldn’t affect equity or liquidity catastrophically, so I think it is safe. I would be comfortable with the ratio going higher.

This is also reflected in the solvency capital requirement (SCR) coverage ratio. SCR represents the maximum loss over the next year at a 99.5% confidence interval. It is required by law to have a SCR coverage ratio of 100% or more. Meeting this requirement implies it would take a 1 in 200 year event to make the company go insolvent. Protector is at 185%, and since this measure is non-linear, at 185% this means insolvency is a virtual impossibility.

The sensitivity analysis breaks down how their solvency would be affected by various risks. They are well within safe bounds. Interestingly they do not mention underwriting error risk in this graph, I would have liked that added.

Ultimately, SCR ratio coverage is good to look at but it is also just a theoretical estimation based on government requirements so we should not put all out faith in their 185% ratio.

The credit risk is mediocre, according to an independent analysis.

Inflation risk will not effect the technical side of the business as they will simply increase prices. Since they are a capital un-intensive business (36% return on equity) capital maintenance costs will be comparatively low which is good (relative to other industries) when prices rise.

Investment side: In year end 2020 the average duration in the bond portfolio was 1.4 years (down from 2 years in 2019). An increase in rates of 1% will lead to a decline in value of 45mil. This is comforting to me as I am worried about a non-transitory period of higher inflation and higher nominal interest rates. Such an environment would be accompanied by negative real interest rates and falling asset prices, would be bad for the investment side. But this is a general risk of being in markets.

On balance the inflation and interest risks in protector are neutral.

INSIDER OWNERSHIP AND ACTIVITY

Sverre Bjerkeli and his family own 3.4% through their company Hvalar Invest.

There has been insider buying up until the stock reaches ca. 100, but not since.

VALUATION – BASE CASE

Premiums written: I expect this to continue to grow at similar rates in the near term but will gradually decline as they saturate the markets they operate in. I have assumed 9% growth in 2022 decline by 1% every year until 2031 where it remains stable. One could argue that growth can be higher since Protector has such a low cost-ratio so they will be able to aggressively price their product and push into new markets. This may very well be, but I like to have a margin of safety.

Net earned premiums: I am roughly estimating gross earned premiums to lag 1 year behind written premiums (on average, I have no clue what the payment plan of current not future policies are). While Protector continues to grow I am assuming a re-insurance ratio congruent with that of the past (15%), but for it to gradually decline towards 10% as growth slows.

I expect corporate bonds to return ca. 3.2% going forward. This makes up 85% of the portfolio. I expect equity returns to be significantly lower in the future than in the past, so I am assuming a 8% return on the equity book despite Dag Marius’ 19% annualized historical return. This makes up 15% of the portfolio. The expected return investment return should then be 3.9%, I am rounding up to 4% to make some allowance for special situations like in March 2020 where the investment team’s skill really shines.

Claims ratio in 2021 was an impressively low 77%, and 84% in 2020. Protector says that covid-19 affected claims ratio positively by 1% in ‘20 and 0.8% in ’21. The positive effect from motor insurance due to decreased cars on the road, which outweighed the negative effects of covid in other segments such as workers compensation (WC) where the Norwegian government decided to classify covid as an occupational disease. This was, again, why they withdrew from WC in Norway. However, policies already written will continue, and some new policies will be written due to existing contracts with companies – these profits or losses will fall under discontinued business. Since I don’t know the duration of the remaining policies it’s hard to estimate this number. From then I think it will gradually decline towards the Norwegian industry average (75%) – this is because I think protector will over time price their policies higher as they focus on profitability and growth slows.

Protectors cost ratio has a historical average cost ratio is 8%. But there has been a trend of this rising over time. In both 2020 and 2021, it was ca. 10%. I also think with the founders now gone (Sverre Bjerkeli) the strength of the culture which allowed this low-cost structure may erode. Either this, or competitors learn the same cost-saving techniques as Protector, pushing premiums down and claims ratio up. That is the nature of all commodity industries over time. Therefore, I am underwriting a gradual increase in cost ratio with a 14% terminal rate. Still lower than the Scandinavian average of 17%.

Calculating float for previous years:

unpaid losses

+ loss adjustment expense

+ unearned premium

+ other policyholder liabilities

- premium balance receivable

- loss recoverable from reinsurance ceded

- deferred policy acquisition costs

- deferred charges on reinsurance

- related deferred income tax

Predicting future float: Protector’s average time between earned premium and claim is 4.5 years. I can take the average premiums earned over the past 4 years, and compare it to float. This tells me that historically float has been 2.3x 4 year trailing earned premiums. Based on my expected earned premiums, I can predict float.

Management has said half of investment funds are made up of float and the other half solvency capital (shareholder capital plus subordinated loan).

The ratio between SCR and earned premiums in previous years was 44%. We can use this to predict what Protectors solvency capital will be in future years by multiplying by their SCR coverage ratio which is at 206%. Their internal guidance says this should be at 150%, which means they actually have a capital surplus of 1165MNOK (excluding announced dividends). I am being conservative by assuming they never pay out this surplus capital.

Together, float and solvency capital tells us how much protector will have to invest.

The difficulty with calculating interest expense is that protector does not state directly what gross interest is. Instead, they only write interest net of income from their bond portfolio. So I simply calculate net interest by extrapolating the historical interest costs as total assets increase.

Tax is a bit complicated for me to calculate here as Protector operates under several tax jurisdictions and there are differences between how operating vs investment profit is treated. I am not familiar with these laws, and it would be too time-consuming to try to calculate what taxes will be under my model – therefore I am just going to take the average effective rate protector has paid in the past 2 years and extrapolate. I am only using the past two years because 2018 and ’19 saw losses and an unrepresentative mix between operating and investment income. This gives me a 16.5% effective rate.

Retained earnings represent the equity that must be retained to fund growth - shareholders exchange this money for growth - which is why it must be subtracted from the DCF model.

Excess Cash: In 2021 protector had a net income of 1204MNOK. 803MNOK have been announced as a dividend – while they sit on the balance sheet this money is excess cash we can subtract from the valuation. According to my own calculations, they are retaining 50mil more than they need for my estimate for next years growth. This implies either (a) they are retaining more than needed to be safe – or more likely (b) they aim to grow more than my model accounts for – realistically (c) a combination of the two. In principle, I should actually add this 50mil to excess cash – but to be conservative I won’t. Besides, I don’t think the cash really is “excess” if they need it as a safety cushion for growth.

Present value is 34.5BN. NOK and IRR at current market capitalisation is 20.7%.

The discount rate used (5%) is based on the opportunity cost of investing in other equities in the Norwegian Market.

Note that after 9th Feb. (div ex-date) valuation is 3kr lower.

CLOSING THOUGHTS

Protector, it seems to me, is an incredible bargain. You get everything you want out of a business for a PE of 8.3. A great business is typically characterised as having high returns on equity with the opportunity to reinvest cash flows to fund equally profitable growth. Protector gives you exactly this. Best in the Nordics when it comes to cost, which is what in the long run determines the technical result. Short term policies which reduce tail risk so solvency capital can be lower. Value of float significantly increased by having a great investment team. Significant capital surplus and falling capital consumption. Great culture, great management. Low/moderate credit risk. Countercyclical industry.

The reason for the low market valuation relative to intrinsic value may simply be a result of the fact that Protector is coming out of a period where earnings were low and it was uncertain whether they would be able to turn the ship again, and that the stock is under-covered and trading volume is low. This results in a lag between business results and a market re-rating. But, I believe as Protectors fundamentals continue to strengthen with profitability and growth it will become increasingly obvious what the value here is. The market is already re-rating this company, and I believe it will continue to. Don’t miss out on a trend because you think it's already over when it’s just getting started!

When it rains gold bring out the bucket, not the thimble!

The downside risk here is minimal and the upside is incredible. I can’t see any reasons my valuation is off but if you do – LET ME KNOW ASAP!