On April 4th, seven weeks ago, Elon Musk disclosed through a filing with the SEC that he had been acquiring shares in Twitter Inc. for several months, accumulating a 9.1% stake and making him the largest shareholder. Since then the situation has developed rapidly into what has become corporate warfare between the world's richest man and a tech giant. For both social and financial reasons I’ve found this situation one of the most interesting out there - and we are now at a point where I believe Twitter's trading price represents a significant opportunity for merger arbitrage. I’ll get back to that later, but first a word on why I’m writing this.

I’ve been analysing public equities and investing in them since my teenage years - and had great pleasure doing so. A large part of that pleasure has always been in sharing and discussing various situations with friends. Perhaps more importantly though, discussion can be a highly efficient format for discovering where I'm wrong. Writing publicly opens the door for more of that - but it also opens the doors to building relationships with like-minded individuals. Over time I hope my ideas will generate alpha and draw in a loyal reader base as well as create a public track record.

The aforementioned coinciding with recent developments, this seems the right time to write my first post on the merger situation with Twitter. I think the market is underpricing the probability that the deal closes and as a consequence, there is a 18% spread we can arbitrage on for an implied IRR around 66%.

The Backdrop

For any readers who have managed to stay away from the headlines, here is a summary of the events which lays the groundwork for the current situation and investment thesis.

Twitter has become one of the most important spaces for incubating elite opinion in the western world. Its moderation policies have long been contentious, and its influence on political outcomes is immense. Financially Twitter has been equally mismanaged - reflected in its pathological unprofitability. Consequently, Twitter has in my view become more of a strategic asset than a financial one.

Contemporaneously, Elon Musk has become the words most prominent techno-utopianist innovator of our time - as well as the richest person in history (by public record). He’s also branded himself a free speech absolutist and ordinates all his actions towards the goal of “maximising the probability the future is good”.

In light of this, Musk’s motivations for control of twitter are clear. He’s said the following of his bid;

"Twitter has extraordinary potential. I will unlock it,"

"I think it's very important for there to be an inclusive arena for free speech."

“[An online speech platform being] Maximally trusted and broadly inclusive is extremely important to the future of civilization"

"not a way to make money," "I don't care about the economics at all."

On April 4th Musk filed a 13G with the SEC disclosing his 9.1% stake in Twitter, making him the largest shareholder in the company. Typically a stake this size would allow enough influence over a company like Twitter (no strong owners) for an activist to extract value. However in Musk’s case, his goals are more ideological and radical than financial which means the resistance he will encounter from management, board, and co-investors will be much greater.

On April 5th Twitter offers Musk a second-tier seat on the board as part of a staggered board structure - indicating that Twitter was already bracing against Musk wielding further influence. Furthermore, a condition for Musk sitting on the board, was that his ownership not surpass 15%.

After a series of eclectic tweets and polls by Musk the following days regarding how Twitter should be run (often phrased as if he already had total control), Musk decides to reject the board seat. I think this happened because the Board could not come to an agreement with Musk about how he should be allowed to communicate with the public as a company fiduciary. Sensing the resistance from management and the 15% ownership cap Musk decided this route would be a dead-end for him.

On April 13th Musk files a 13D with a non-binding offer to buy the entire company for $54.2 a share.

At the time some speculated that Musk’s offer was unserious and that it was an attempt to pump and dump his existing shares after losing a battle with the board. To me, it was obvious that the offer was serious given what we know about his motivations.

By the 21st Musk had secured $46.5bn in financing through a combination of equity, debt, and margin both collateralised by his Tesla stock. Thus rebuffing any claims that he didn’t have the funds, or had no intention of following through on the deal.

Consequently, the ball came into the board's court, prompting them finally accept the offer - winning Musk the game. Frankly, I was somewhat surprised that they accepted it so quickly without attempting to negotiate on price or find a white knight.

The Merger Agreement

The details of their agreement were disclosed by Twitter in an 8k filed on April 25th. From it, we learned that Musk’s newly formed holdco X Holding I and X Holding II had entered a merger agreement with Twitter. X Holding II is a subsidiary of X holding I - this structure opens for others to join Musk in his deal. The merger agreement was unanimously approved by the board along with a resolution to recommend shareholders approve the Merger agreement and Merger.

At the time of the Merger, common stock will be converted into the right to receive $54.2. Options and the like will be cancelled and converted into the right to receive cash.

Importantly, conditions for closing were disclosed as 1) shareholder approval 2) antitrust approval 3) other legal prohibitions. Here's my take on them.

1) Shareholders will vote in favour of the Merger. The logic here is simple. Massive attention has been drawn to Twitter in the past month resulting in huge trading volume - the shareholder base has totally shifted. The people selling the shares were the ones either against a takeover or not believing it would happen, and those buying the shares were betting on it happening. So the only people left are those who will vote yes! Not to mention the massive premium the bid represents to twitters trading price. Furthermore, Twitter would have to pay a termination fee of $1bn if shareholders don’t pass it.

2 and 3) There should be no anti-trust issues here as X holdings is a shell and Musk has no prior stake in social media companies, so his acquisition does not hinder competition and regulators will approve the transaction. I am unaware of any other potential legal issues, and assume if they existed would have been brought to my attention.

There are also some covenants to the agreement which can be summarised as follows;

Twitter cannot engage or otherwise solicit a process which would lead to a competing bid.

The Twitter board cannot recommend shareholders vote against the merger agreement or for any competing bid.

Twitter will file an SEC proxy statement relating to the adoption of the merger agreement as soon as possible. (See filing here)

Twitter will hold a special meeting to approve the agreement as soon as the proxy statement is complete. (See filing here)

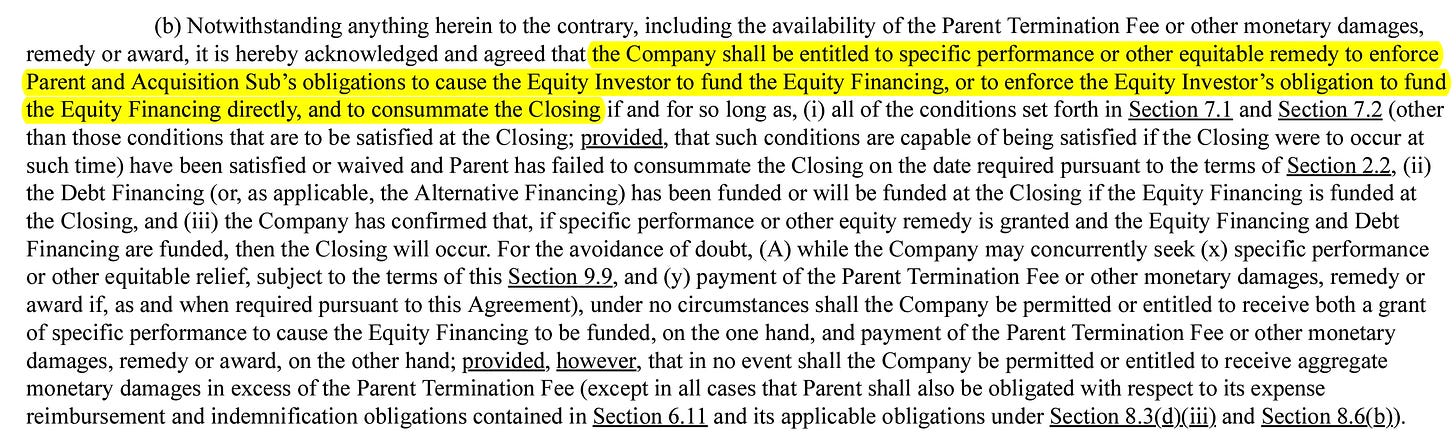

The issue of the reverse termination fee has been fairly contentious in the commentary, with many alleging it serves as a call option for Musk. However, the agreement states in no unclear terms that the agreement may only be terminated if a) The merger has not been consummated by Oct. 24. ‘22. (Both parties may terminate it in this case.) or b) Shareholders fail to adopt the merger agreement.

If these conditions are met, the agreement may be terminated and a fee of $1bn must be paid to the counterparty.

Specifically, the fee is payable by Twitter to Musk if 1) Twitter terminates the agreement to enter into a competing and superior bid. 2) Musk terminates because the TWTR board has recommended shareholders against adopting the merger agreement OR in favour of a competing bid 3) there is a competing bid for TWTR. 4) Shareholders fail to adopt the agreement 5) twitter materially breaches the agreement and within 12 months enters an agreement for a competing bid.

Specifically, the fee is payable by Musk to Twitter if 1) Twitter terminates the agreement because Musk has failed to consummate it. 2) Musk breaches his representations, warranties, or covenants in a way that would cause the aforementioned closing conditions not the be satisfied.

The Current Setup

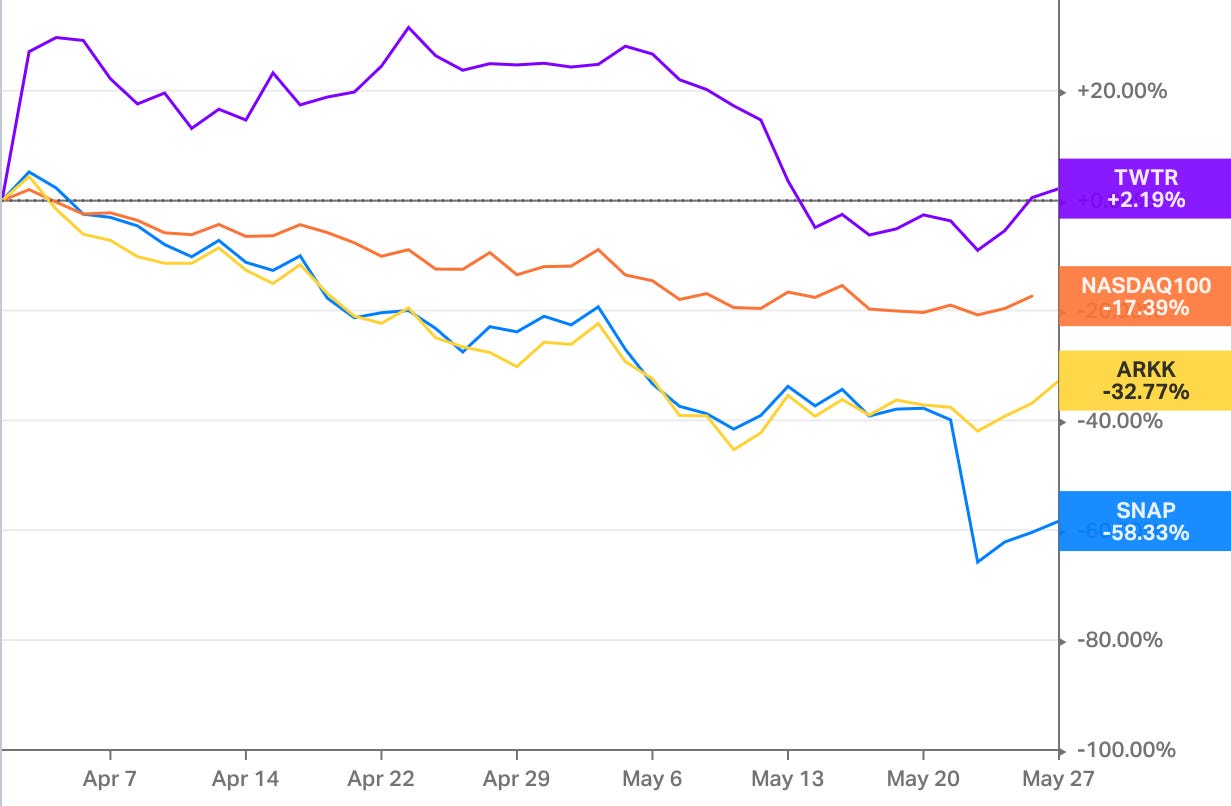

Since the merger agreement was signed we've seen substantial turbulence in the markets. Both bonds and equities are pricing in higher interest rates and inflation. Unprofitable tech (like Twitter) has been hit particularly hard. Absent the pending acquisition by Musk TWTR would likely be trading around $30. Furthermore, the Tesla stock Musk still needs to fund the acquisition is declining in value. Musk essentially agreed to take Twitter private at a premium to trading price at the very peak before a crash in unprofitable-tech stocks which has been the worst since the dot-com bubble. Naturally, Musk is looking for any way to get out of the current deal or renegotiate the price. I don't believe he will be able to.

Since Musk tweeted that the deal was "on hold" the stock has traded down to $40, representing $14.2 (35%) spread between the $54.2 deal price. The market is effectively pricing in approx. 45% chance the deal gets completed as it stands today.

I think the chances are much greater than that. I will walk through the possible outcomes but essentially I believe the Merger agreement makes it very difficult for Musk to negotiate or get out of the deal. Most likely the deal will close as is or get re-cut at a token discount. And if Musk violates the agreement by not consummating the merger Twitter will sue him for specific performance in a case which will be settled in a matter of months.

Materially adverse effect is another. MAE is an event or change in circumstances in the target that is adverse and significant such that the buyer is reluctant to proceed with the deal on the agreed-upon terms.

The recent market decline which has hit unprofitable tech stocks like TWTR particularly hard is a change in external circumstances, not a change in Twitter itself. The fact that other companies have gotten cheaper is not an argument for material change relative to the terms agreed upon.

The discovery of bots would also not be a material event or change. The bots were already there, so if there is an issue it's one of due diligence, not MAE. Furthermore, MAE has a high burden of proof, and Delaware courts have only ever found MAE once (to my awareness). So there is no path here in terms of MAE.

However, that doesn’t mean Musk can’t litigate over it, or use the threat of drawn-out litigation as a tool for negotiating a price cut.

This seems to be the path Musk is going down now by raising the issue of bots. He says Twitter has reported that around 5% of users are bots but in reality, there is much evidence to suggest the number is significantly higher. I think Musk is probably right here, but I think it also doesn't matter if there are more bots than Twitter disclosed. The fact that this is the best card Musk has on hand really demonstrates to me how weak of a position he is in.

Firstly, whatever the number of bots is, this is already baked into the mDAU's and other financials. We know how well Twitter can monetise users on average and we know what their bottom line is - whether bots account for 5% or 50% of the user base doesn't change that. It's also not relevant to advertisers how many bots there are because they simply measure performance based on clicks. Point is, that the number of bots has zero financial relevance and therefore cant be used as an argument that Twitter is worth less. Even if it did, Musk has said he doesn't care about the economics of the business.

Now you can argue that when it comes to awareness advertising as opposed to sales advertising the number of real users does matter. The argument would go that since you are simply trying to make people aware of your brand and build its image you can’t measure the effectiveness of ad spending if you don't know how many impressions are from bots. But advertisers still have other ways of measuring performance. They can look at relationships between ad money spent on a target group and increased web/sales traffic. They can look at the quantity and quality of engagements as opposed to impressions. And surely they have other methods I'm not aware of. Advertisers are not so ignorant as to indiscriminately spend ad money on a platform and not try to measure what they will get out of it. Again we end up concluding that any number of bots on the platform are already baked into the financials.

Secondly, Musk has said repeatedly, both prior to and after making the deal, that he's aware of the bot issue on Twitter. In fact, it's worse than that - he's said that fixing the bot problem is a central reason for buying the platform. How can it be argued that one of his main reasons for entering the agreement is now something he was unaware of and materially deleterious to the acquisition value?

Thirdly, Musk waived most of his rights to due diligence when he signed the merger agreement. The agreement reads "At the time of delivery, the Proposal was also subject to the completion of financing and business due diligence, but it is not longer subject to financing as a result of the reporting person's receipt of the financing commitment described below and is no longer subject to business due diligence". Musk pretty much agreed to buy the company "as is", has no right to conduct due diligence or use new information as a basis for negotiation.

The board has solid footing here, but nonetheless, they may accept a token recut of the price to appease Musk, get the deal done, and move on in what is an uneasy market and already represents great value for shareholders.

That leaves us to wonder how steadfast the board will stand their ground, and how well they will negotiate. Reading between the lines, i think there are four reasons to believe they intend to push forward with the deal as it stands.

1) Parag Agrawal's tweet thread on bots.

In this thread, Parag explains the process Twitter uses to detect spam and bot accounts and defends their estimate for 5% bots. To me their methodology seems reasonable but probably flawed, and Musk has some ideas to improve it - but none of that matters here. What matters is what this thread tells us about Parag's attitude towards Musk's claims, namely that has an actively defensive stance against them rather than a passive one. Parag is not the lone warrior type either, so his stance likely reflects the position of the board and Twitter's position.

2) Board re-iterates they are committed to deal

Lucky we don't actually need to speculate on the board's position as their recent SEC filing says "Twitter is committed to completing the transaction on the agreed price and terms as promptly as practicable" and "The Board and Mr Musk agreed to a transaction at $54.20 per share. We believe this agreement is in the best interest of all shareholders. We intend to close the transaction and enforce the merger agreement"

3) There is no such thing as a deal being "On Hold"

Musk tweeted that the deal was "on hold". Twitter's top lawyer Vijaya Gadde told employees at an all-hands meeting that there's "no such thing as a deal being on hold". Of course, she is completely correct. There has been no SEC filing detailing pending due diligence, renegotiation, or termination - all that's happened is a tweet. As far as the process is concerned it should move on exactly as if nothing has happened.

4) Twitter files proxy statement for a shareholder vote

And that's what Twitter is doing, proceeding with the merger process exactly as if nothing has happened. A few days ago they filed the proxy statement for a shareholder vote on adopting the merger agreement - the path detailed by the agreement.

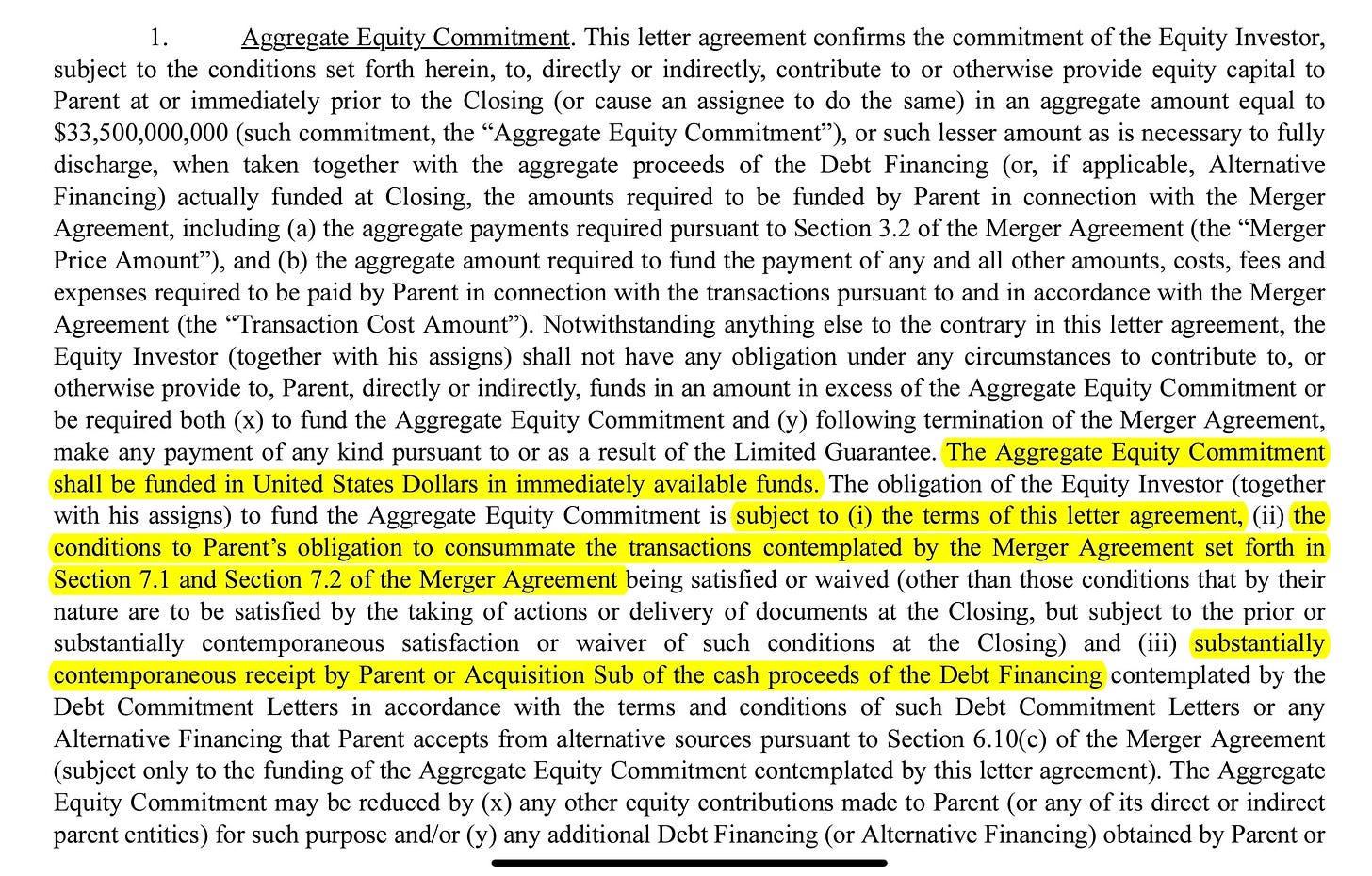

Until most recently the largest risk to the deal was Financing. Originally Musk committed to providing X Holdings I with $21bn in equity, Morgan Stanley committed $13bn in LBO debt, and Morgan Stanley (in cooperation with other banks) committed $12.5bn as a margin loan. The Margin loan in combination with Musk's existing stock pledges to other debt, and a falling $TSLA price risked MS pulling the financing. Since then Musk has in two separate letters of equity commitment entirely removed the margin portion of the financing and replaced it entirely with equity. Currently, the deal is to be financed with $33.5B in equity and $13B in debt ($6B of which is a bridge loan @>11%APR). Not only does this de-risk the financing but it signals Musk is moving to close the deal.

Where will Musk get the equity?

Where will he get the rest? Nov. and Dec. last year Musk sold 10% of his TSLA shares for $16.4B while exercising 22.8mm options at a strike price of $6.24 costing him $1.4B. After the $11B in taxes he has to pay related to exercising these options he should have $4B in unrestricted cash. His 9.6% stake in Twitter cost him $2.65B. In April he sold another $8.5B in TSLA. The effective federal capital gains tax rate is 23.8% and the Texas rate is 0% - so he will be taxed $2B on the sale. Right now Musk should have $8B in unrestricted cash.

Adding the 73mm shares ($4B) he already owns, Musk needs an additional $21.5B in equity.

On may 5th it was broadly reported that Musk had secured $7.1B from co-investors. Notably, this includes Saudi Prince Alwaleed Bin Talal who has publicly said he will roll his equity, Larry Ellison committing $1B, and Changpeng Zhao with $500mm. I think it's also likely Jack Dorsey rolls his equity.

"Raising fifty million dollars is a matter of making a series of phone calls, and the money is there" -Elon Musk recalls raising money for X.com

Phones must have been ringing in the past couple of weeks because Musk would not have committed the additional equity was he not assured he could get it. We haven't seen any filings disclosing further TSLA sales. I think Musk has gotten significant additional commitments from co-investors and that this will be reported in the media in the coming weeks creating a catalyst for the stock price. If I were one of these co-investors, I would be buying as much TWTR stock on the open market right now as I could - assuming I wasn't breaching any insider trading laws.

Depending on how much Musk gets from co-investors he will likely still be short $5-10B. SpaceX is currently raising equity and there are rumours Musk will be selling some of his shares. Regardless, the majority of the cash will need to come from more TSLA sales (his stake is currently worth about $160B). Despite significant selling pressure and volatility in the stock recently, this is totally doable for Musk. We will at some point see an SEC filing disclosing further sales. Additionally, he will need to repay the $6B bridge loan after the acquisition.

Just one problem, none of the co-investors are contractually bound to deliver anything. And for every day the market keeps crashing and liquidity conditions keep tightening it will be less attractive to buy Twitter at $54.2. While none of these people are bound to buy, Musk is. If some of his co-investors leave he will have to find new ones or make up the difference himself. There is a scenario where Musk is ruined by a $15B liability and a crashing TSLA price. Until co-investors are formally assigned and accepted with respect to the “Aggregate equity commitment”, they are not legally bound, and this risk remains.

That leads us to another big question. If Musk cannot finance the deal without selling other assets - can he refuse to sell those assets leaving him unable to finance the deal and thus triggering the reverse termination clause of the merger agreement? And if Twitter litigates over this, can the court force Musk to sell assets to finance the deal? To answer this, we must take a closer look at the merger agreement.

I read this language as quite strongly enforcing Musk's personal obligation to finance the deal. However, forcing Musk to sell a substantial part of his net worth and equity stake in TSLA is quite would also be a drastic measure by the court. Furthermore, the letter of equity commitment says “The Aggregate Equity Commitment shall be funded in United States Dollars in immediately available funds”

Notably, that commitment is subject to i) the terms of the letter of equity commitment, ii) section 7.1 and 7.2 of the merger agreement, and iii) the receipt of debt financing.

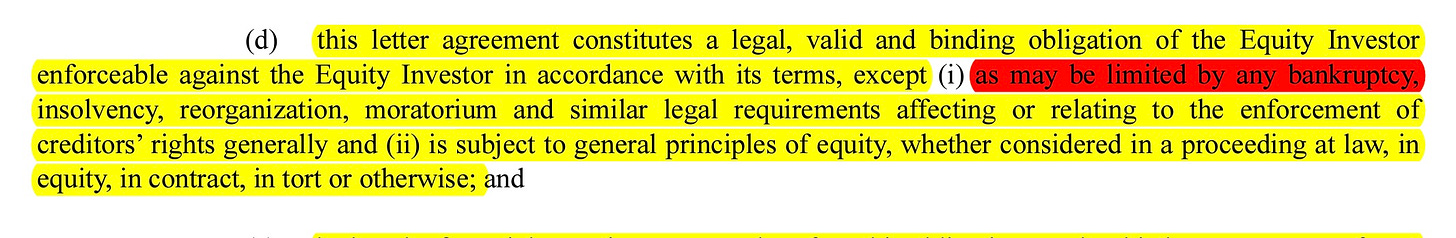

Sections 7.1 and 7.2 of the merger agreement say nothing about the specific enforceability of the equity commitment, and nor does the debt financing. The only thing left to define the terms are the letter of equity commitment itself, which says the commitment is “limited by any bankruptcy”. But again, the commitment is only in “immediately available funds”.

If we take "immediately available funds" in its most extreme interpretation it would allow Musk get out of the deal on a whim by getting rid of immediately available funds by buying any sort of liquid asset (stocks or bonds). Clearly, this can't be the case, so then there remains ambiguity as to how bound he is to provide equity in edge cases and to what extent courts can or would be willing to force the sale of assets to close the deal.

To further resolve uncertainty I would have to speak to a legal expert or review how courts have historically dealt with such situations - this will remain homework for another day.

For now, I put that probability that Musk doesn't commit the equity (either because he doesn't want to or can't) AND the court does not order a sale of assets at 5%. There are a number of ways we can get into this situation, but I will leave it here and not detail all of them.

Musk has a history of violating the law. What if he does not follow through on a court order for specific performance? If such an order involved selling assets, Musk becomes in a financially tight situation, and markets remain volatile, then doing something as innocent as being 'late' to sell those assets may render the remedy redundant. Ultimately this scenario is possible but I think it's a <3% probability. Even for Musk, such contempt of court is too far, and he would not risk going to prison over it.

Ancillary Risks

1) Musk dying or getting criminally convicted - 5%

Death is always a background risk, maybe it's a litter higher than average for Musk but not especially so. Musk is currently under several investigations, and there is some probability they will result in a conviction. Put together I put these risks at 5% - if they materialize the deal would stop dead.

2) Anti-trust or other legal barriers - 1%

Musk's acquisition would not hinder free competition so there's no reason it wouldn't get approved. I am not aware of other laws prohibiting the acquisition. If this materializes the deal would stop dead.

3) Supermajority shareholder vote is required and the merger agreement is not adopted - 7.5%.

The Orlando Police Pension Fund is suing Twitter Inc et al (the board, executives and Musk) to stop the acquisition. The suit claims that Musk was, at the time the merger was signed, an "interested stockholder" under section 203 of Delaware corporate law. The section says that a corporation should not engage in business with an interested stockholder for a period of 3 years after they became an interested stockholder - UNLESS it is approved by 66.7% of shareholders (excluding the vote of the interested stockholder himself).

An interested stockholder is defined as one who holds a 15% stake or higher. Musk's stake being at 9.6%, this shouldn't be a problem. However, the plaintiff claims that Musk had an "agreement, arrangement or understanding" with two other major shareholders Morgan Stanley (8.8%) and Jack Dorsey 2.4%. Such an "agreement, arrangement or understanding", would under section 203 constitute an "interested stockholder".

I haven't investigated how strong the legal case here is, so I can't meaningfully assess who will win here. What I can say is that I don't think it matters. Should the plaintiff win, I think a supermajority of shareholders will approve the deal anyway. With the Nasdaq in the dumps, the acquisition represents such a superior proposal that it would be asinine to vote against it. I put the probability that this breaks the deal at 7.5%.

Concluding thoughts, and how to play this

Summing up the probabilities arrived at in the above analysis; I think there is a 21.5% chance the deal breaks, a 20% chance it gets renegotiated at a slightly lower price and a 58.5% chance it closes as the agreement currently stands.

This chart shows the development of TWTR stock price relative to comparable stocks from the day before Musk disclosed his initial holding. There is a large degree on uncertainty in guessing where this would trade absent an acquisition, but using ARKK as a reference (which i think is fair) TWTR should be trading just above $25.

If we also assume that a recut deal would land at $50 we can do some simple math landing us at a probabilistic fair value of $47. On the latest price of $40 there is $7 (18%) worth of arbitrage here, for an implied IRR of ca. 66% assuming this closes by mid-October.

Personally, think the best exposure to this is through the common stock. The downside risk is only moderate, there is no clear timeline, and the closing price is uncertain - so I wouldn't know how to price a call option. Good luck to all involved!

If you found this article and analysis useful please subscribe for free! The Next edition will be on Protector Forsikring, a criminally undervalued Norwegian insurance company which has the best cost structure in the industry, high organic growth, and high returns on equity yet is overlooked by the market!

Full disclosure, I am long Twitter.